Unlocking the Door to Housing: A Dive into the Realities and Hopes for Housing Affordability in the Grand Canyon State

Imagine this: You've just landed a job in one of Arizona’s towns, and the future is looking bright... until you start house hunting. You're not alone in this quest, as the dream of access to housing in Arizona seems to be drifting further away for many. But why is this happening, and what does it mean for folks like us who call this state home? Let's unpack this with recent data from our Arizona Progress Meters.

The Housing Puzzle: Why Your Paycheck Doesn't Match the Price Tag

You don’t need to be a real estate guru to notice that housing prices in our state are skyrocketing – when we surveyed Arizona voters in 2022, folks of all political affiliations and age groups expressed concern. The math is simple: while our paychecks have been slowly inching up, the cost of homes has leaped. Take Phoenix, for instance, where incomes rose by 43% from 2016 to 2022. Sounds great, right? Hold that thought — house prices shot up by a staggering 76% during the same period. That's like running a race where the finish line keeps moving further away – no wonder people have been concerned.

And this isn't just about numbers on a chart. It's about real people — our teachers, nurses, firefighters, retail and tech workers — who are finding it increasingly tough to afford a home in the community they serve. It's about our younger Arizonans, the spirited individuals fresh out of college, starting to question if they'll ever afford a home in the neighborhoods they grew up in, nearby, or in our great state at all.

Decoding the Dilemma: What's the Deal with Affordability?

When we talk about housing affordability, we mean homes (owned or rented) that don't require more than 28% of someone’s income. So, how does Arizona fare on this front? We've seen better days.

Back in the day, Arizona was a haven for homebuyers, with more than half the homes sold being affordable. Fast forward to today, and affordability by definition is seen in just two regions — Sierra Vista and Yuma. For our friends in Prescott, the scenario is pretty grim, with less than a quarter of homes within reach.

And it's not just about buying. Renting isn't any easier. The suburbs command rents that are a pie in the sky for most median-wage earners.

Why Should We Care, Arizona?

Housing affordability isn't just a buzzword — it's critical for our quality of life, and it’s a priority for Arizona voters. It's what ensures our essential workers don't have to commute insane hours, all our neighbors are housed, and our neighborhoods reflect the rich tapestry of generations and cultures.

CFA's surveys echo this sentiment loud and clear. A whopping 80% are concerned over spiraling house prices and rents. More importantly, an overwhelming majority believe it's our state and local governments have a role to play.

Steering the Ship: Our Course of Action

All's not lost! There's a silver lining with some regions like Sierra Vista-Douglas and Phoenix-Mesa-Scottsdale witnessing a glimmer of hope and a slight uptick in affordability in 2023. It's a sign that with concerted effort, change is possible.

Many ideas and potential solutions are swirling about how we can tackle this head-on. And it’s not just about building more homes — it's about building the right homes, in the right places, for the right people. That’ll take thinking differently and new solutions – and utilizing trusted data to be well-informed on this front will be key.

Your Role in Rewriting Arizona's Housing Story

This is where we all come in. Leaders, innovators, philanthropists, everyday Arizonans — this is our community and a call to shape the future we want to see. Whether it’s backing policies that address Arizonans' specific housing affordability concerns or simply spreading the word on the latest affordability data — every action can make a positive contribution.

Together, we can ensure that the Arizona dream is not just for the select few but for all who seek the dignity of a place to call home – this is what Arizonans want for all.

Dig Deeper – Full Data Analysis

Arizona Progress Meter Update on Housing Affordability: Some Progress, but Challenges Persist

Housing is a key factor in keeping Arizona's young talent in the state. The National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index, updated quarterly, provides insights into local housing affordability. It serves as a key metric for Center for the Future of Arizona's Arizona Young Talent Progress Meter, by gauging the affordability of homes for the average income household. It represents the percentage of accessible homes on the market translated into an index score. The NAHB defines a home as affordable if the rent or mortgage costs are less than 28 percent of a household's income (the Federal Government measure this at 30 percent). It's worth noting that the affordability of homes is influenced by interest rates, especially in the context of mortgage payments.

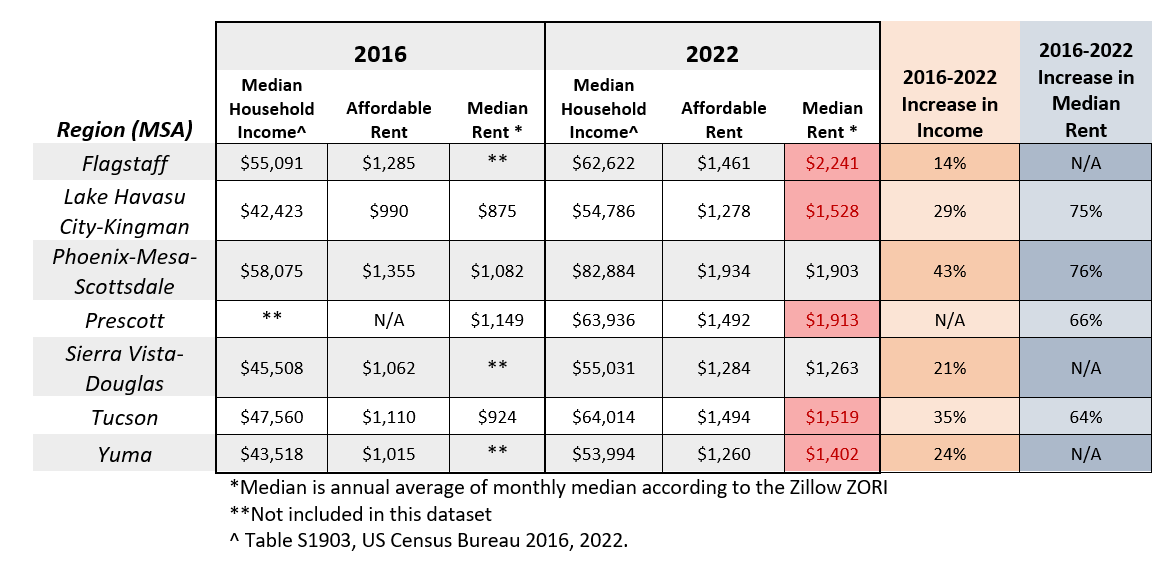

The most recent update shows that in 2023, affordability has improved in four of Arizona's seven municipal statistical areas (MSAs). In the remaining three areas, housing affordability challenges continue. Median wages can’t keep up with the increasing cost of homes. The chart below demonstrates the median household income in Arizona's seven MSAs, according to the U.S. Census Bureau, in 2016 and 2022. The chart also provides insights into affordable rent payments for each geographical area in those years.

The data in Table 1 indicates that median-income households have been able to afford the median rent in Arizona's cities as recently as 2016. However, more recent years have seen a decrease in affordability. While the median income increased by 43 percent in Phoenix, for example, from 2016 to 2022, the median rent increased twice as fast by 76 percent over the same period.

Table 1: In 2016, the median rent was affordable to median-wage households in all of Arizona’s MSAs for which data are available, but by 2022, median rents had increased much more, leaving the median-wage household unable to afford the median rent in Flagstaff, Lake Havasu-Kingman, Prescott, Tucson and Yuma.

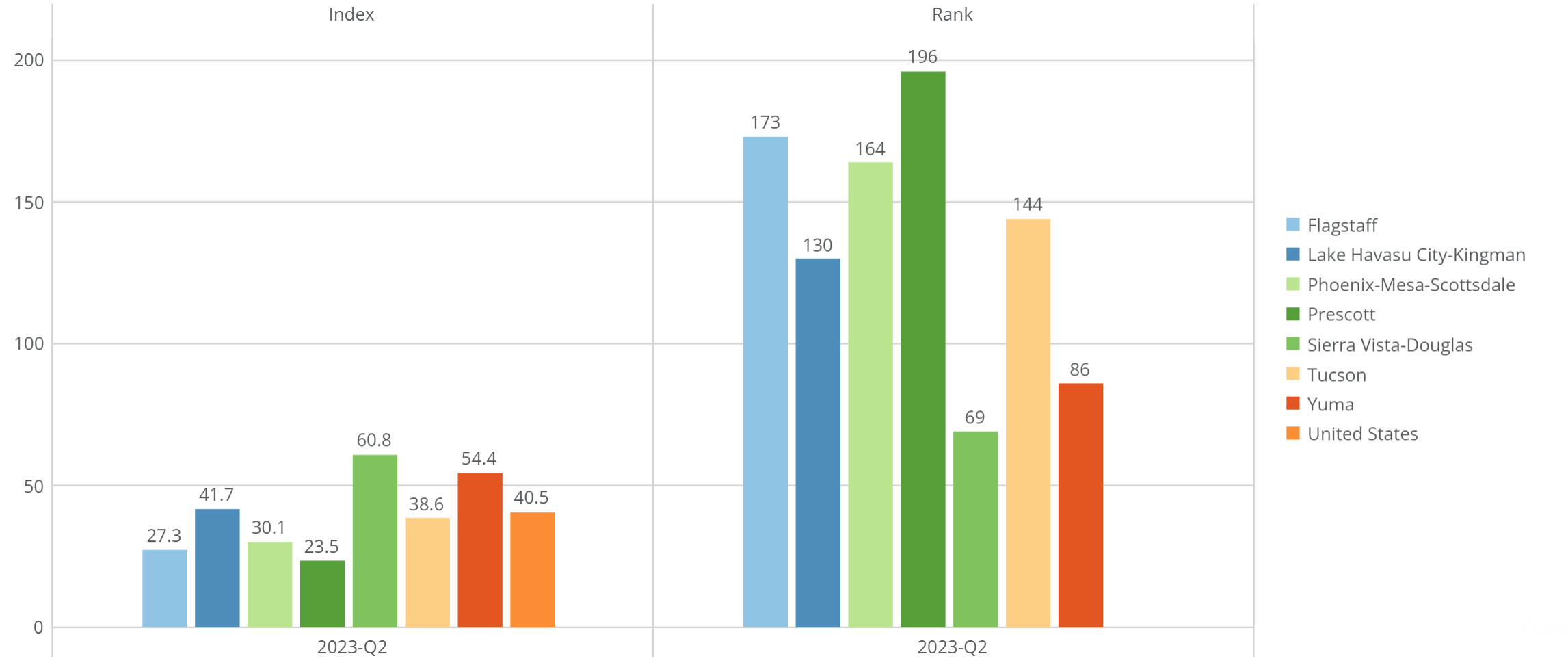

The median home price is just one factor in understanding housing affordability. Housing prices span a wide range, making it challenging to gauge the true state of housing affordability. The Housing Opportunity Index provides a clearer picture as it shows what percentage of homes sold are considered affordable to the local median wage household. In an ideal scenario, 50 percent or more of the housing market would be affordable, as the median income is the 50th percentile, meaning half of the households make the median income or more.

Historically, Arizona's communities were more affordable, with an index score that exceeded 50. However, this is currently the case for only two regions – Sierra Vista and Yuma – as depicted in Figure 1 below. . Sierra Vista-Douglas was the 69th most affordable in the most recent period, whereas Phoenix ranked 164th.

Figure 1: As of the second quarter of 2023, only two of Arizona's MSAs have more than half of the housing affordable to the median household income, meaning a score of 50 or higher.

Among Arizona's urban MSAs, Sierra Vista stands out as the most affordable, with an index score of 60.8, meaning 60.8 percent of homes sold are affordable to the median wage earner.

On the other end, Prescott ranks as the least affordable, scoring only 23.5. It is essential to remember that this issue extends beyond Arizona, with the national average indicating that 40.5 percent of homes are considered affordable.

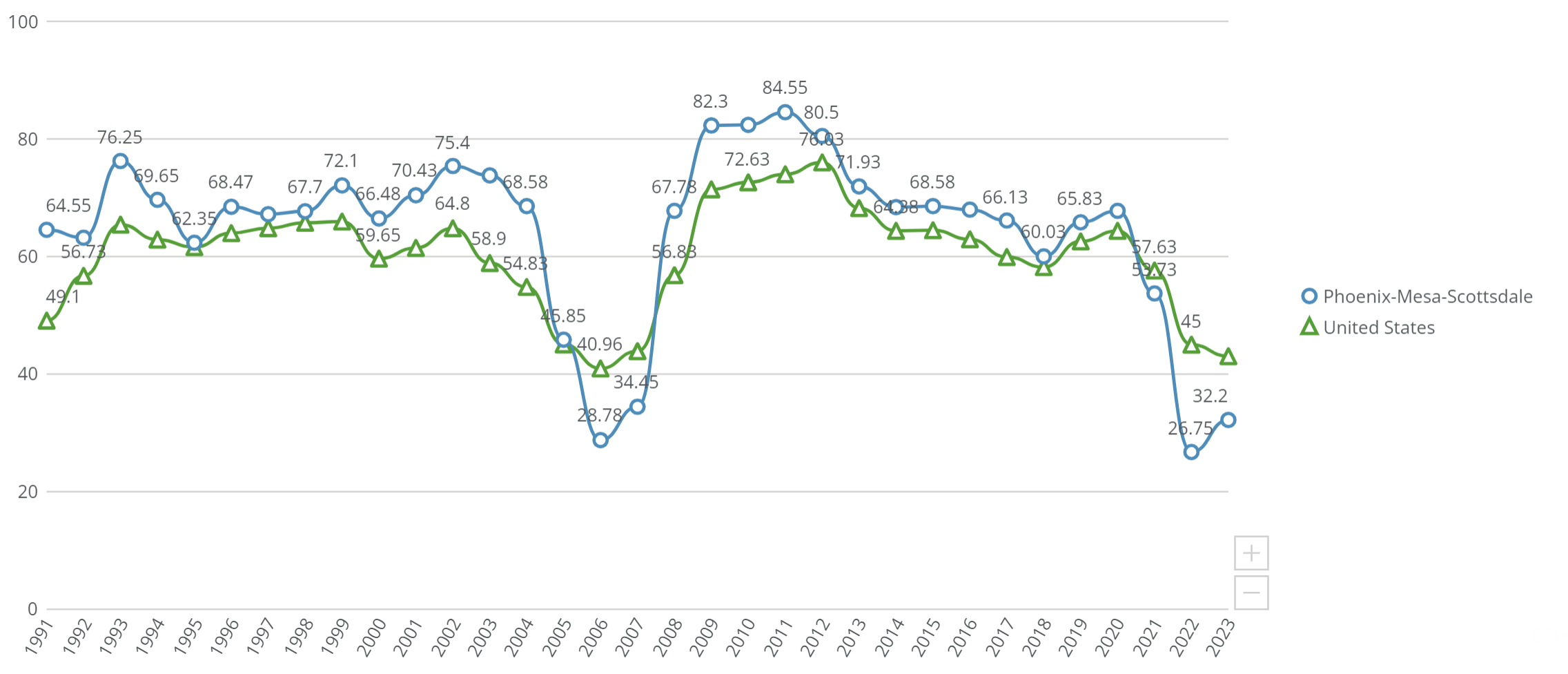

Trends indicate that we see some slight improvement in the most recent data. As shown in Figure 2, dating back to 1991, when data collection began, housing in the Phoenix MSA has been traditionally more affordable than the national average. The only exceptions were before the Great Recession of 2006-2007 and more recently in 2021-2023. Generally, about two-thirds of homes sold in Phoenix are affordable to the median wage-earner, but as of 2023, only about one-third of homes meet this expectation.

Figure 2: Generally, 2 in 3 homes sold are affordable to Phoenix-area median income household. In recent years, this is no longer the case.

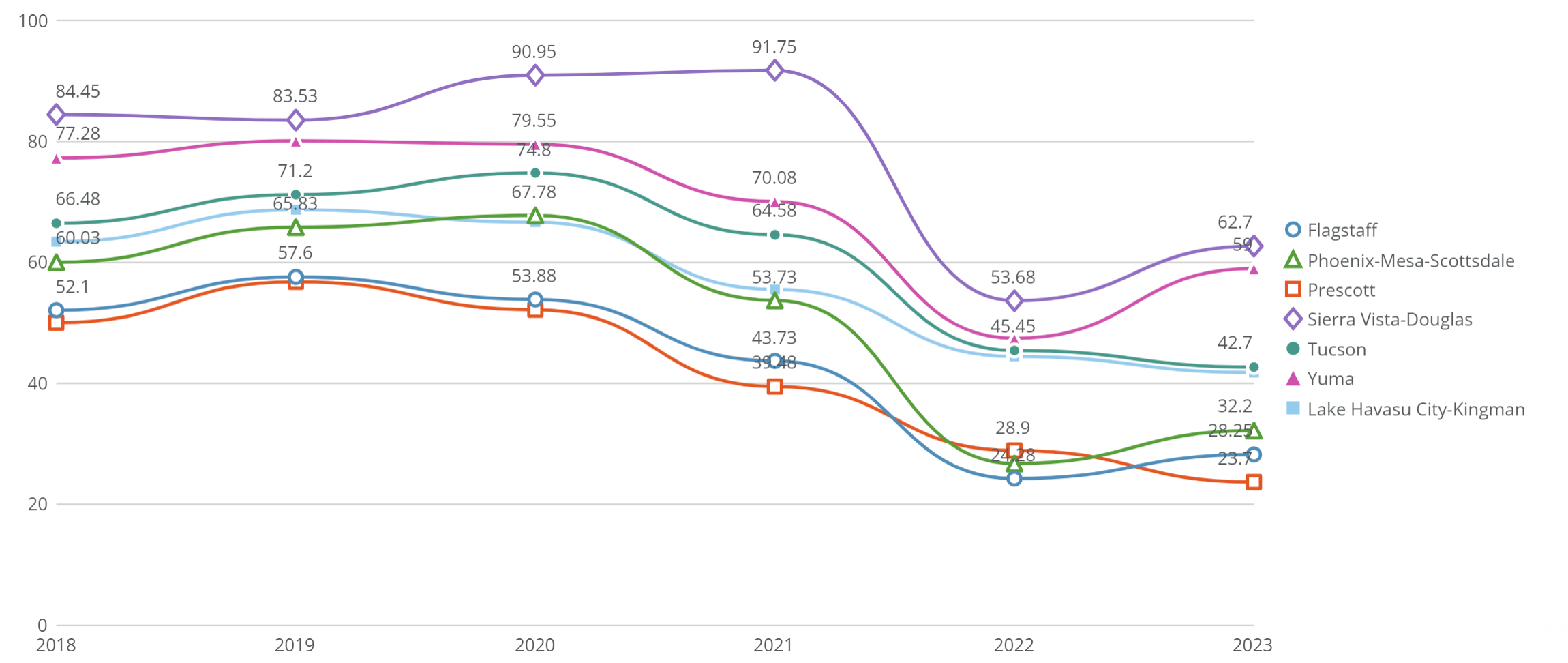

Affordability has been a statewide concern for the past five years in Arizona. In 2021, more than 9 in 10 homes in the Sierra Vista region were affordable to the local median income household, but by 2023, this figure has dropped to around 6 in 10 houses. Similar declines are seen across the board, with an index score below 50 in all regions except for Yuma and Sierra Vista-Douglas.

On a more positive note, there has been slight improvement in four markets, indicating that it is becoming more likely for median wage-earners to find a home in Sierra Vista-Douglas, Yuma, Phoenix-Mesa-Scottsdale, and Flagstaff. However, the downward trend persists for Prescott, Tucson, and Lake Havasu City-Kingman (Figure 3).

Figure 3: Since 2020, fewer homes have been affordable for the median wage-earner in all of Arizona's MSAs. Slight improvements have been seen in 2023 for four of the seven MSAs.

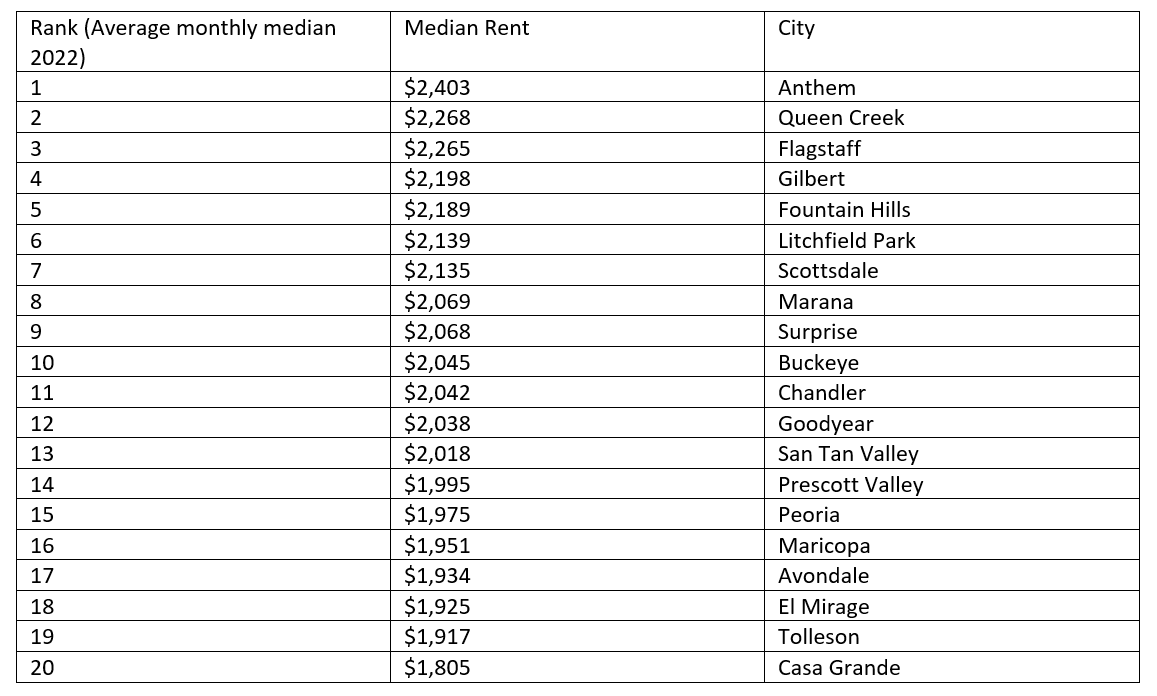

Additional data from the Zillow ZORI dataset provide some context on Arizona's overall most expensive cities. Below are the top 20 cities in the state, ranked from the most expensive median rent to the lowest (Table 2). This list does not include data for smaller communities, such as Sedona (ranked #1 in 2023).

Table 2: The average monthly median rent for 2022 indicates that rent is out of reach for most median-wage households in Arizona's cities. Higher rent communities appear to be primarily suburban, where houses, rather than apartments, dominate the rental market. (Source: Zillow ZORI data. August, 2023)

Housing affordability is a significant challenge nationwide. When homes are too expensive for the median wage-earner, it can lead to higher rates of homelessness, reduced disposable income to spend on other necessities, difficulty attracting workers to less affordable regions to take jobs, and various other challenges. Availability of long-term rental supply is a known challenge in many of Arizona's attractive mid-sized cities like Flagstaff and Sedona, where short-term rentals and limited availability of land for new neighborhoods, among other challenges, have reduced housing availability for residents.

Several initiatives have been proposed to help address this challenge, including restrictions on short-term rentals, incentives to encourage landlords to provide long-term housing, increased construction of for-rent communities, and programs to support the purchase of homes.

The home affordability crisis is a challenge in most of Arizona's cities. It is particularly acute for younger Arizonans with relatively lower wages and household wealth. This data is included in the Arizona Young Talent Progress Meters, which addresses issues identified as top priorities by young Arizonans. These concerns encompass mental healthcare, cost of living, cost of housing, quality of higher education, and various other topics – areas to address to keep our talented Arizonans contributing to Arizona for years to come.

Why is Housing Affordability Important?

Our recent surveys have indicated that housing affordability is a significant challenge for many Arizonans. Affordability does not impact everyone equally, as housing costs are particularly unaffordable for lower-wage households, which include younger people and people of color. In 2020, we discovered that nearly 28% of Generation Z individuals, born between 1997 and 2012, struggled to cover their housing costs during the previous year. The issue is also more acute for certain races and ethnicities, including 55 percent of Native Americans and 1 in 3 Black Arizonans.

Our 2022 survey of likely voters revealed that 80 percent of Arizonans believe house prices and rental rates are out of control, while 83 percent agree that state and local governments have a role in ensuring people who experience homelessness can find safe, affordable housing. Of Arizonans, 78 percent, including two-thirds or more of every age group and political affiliation, support the idea of promoting workforce housing. These homes are priced to be affordable for those in the workforce, including essential workers like teachers, nurses, first responders, and other community employees. The objective is to ensure that essential workers have accessible housing options within our communities.

About Our Data Sources

As with all the Arizona Progress Meters, data are publicly available from a trusted and regularly updated source. Data included in this update is from the National Association of Home Builders. Additional data from Zillow cited in this piece are not a part of the Arizona Young Talent Progress Meters but provide context.